Maximize Travel with Credit Card Rewards Points: A Beginner's Guide

Do you dream of traveling the world but think it's financially out of reach? What if I told you that you could significantly reduce your travel costs, or even travel for free, by leveraging the power of travel hacking credit card rewards points? It sounds too good to be true, but with a little knowledge and strategic planning, you can transform your everyday spending into incredible travel experiences. This guide will walk you through the basics of travel hacking, showing you how to accumulate and redeem points effectively, and ultimately, maximize your travel adventures.

Understanding the Basics of Travel Hacking with Credit Cards

At its core, travel hacking is the art of strategically accumulating and redeeming rewards points and miles to minimize travel expenses. The primary tool for travel hacking is the credit card. Not just any credit card, but specifically travel rewards credit cards. These cards offer points or miles for every dollar you spend, and these rewards can then be redeemed for flights, hotels, rental cars, and other travel-related expenses. Think of it as getting paid to spend, but with a bit more nuance.

The Lingo: Points vs. Miles

Before we dive deeper, let's clarify the difference between points and miles. While the terms are often used interchangeably, they can have slightly different meanings. Generally, "miles" are associated with specific airline loyalty programs (e.g., United MileagePlus, American Airlines AAdvantage), while "points" are often associated with credit card rewards programs that offer more flexibility (e.g., Chase Ultimate Rewards, American Express Membership Rewards). Points can often be transferred to airline or hotel partners, effectively converting them into miles within those specific programs.

The Power of Sign-Up Bonuses

One of the quickest ways to amass a significant number of travel hacking credit card rewards points is by taking advantage of sign-up bonuses. Credit card companies frequently offer substantial bonuses to new cardholders who meet a minimum spending requirement within a specific timeframe (usually the first 3 months). These bonuses can be worth hundreds or even thousands of dollars in travel value. It's crucial to strategically choose cards with sign-up bonuses that align with your travel goals and spending habits. Always read the fine print and ensure you can comfortably meet the minimum spending requirement without overspending.

Choosing the Right Travel Rewards Credit Card: A Strategic Approach

Selecting the right travel rewards credit card is paramount to your success in travel hacking. Not all cards are created equal, and the best card for you will depend on your individual spending patterns, travel preferences, and financial situation.

Evaluate Your Spending Habits

Start by analyzing your spending habits. Where do you spend the most money each month? Do you dine out frequently? Do you spend a lot on groceries or gas? Look for cards that offer bonus rewards in categories where you spend the most. For example, if you spend a significant amount on dining, a card that offers 3x points on restaurant purchases would be a valuable asset.

Consider Your Travel Preferences

Think about your travel goals. Do you prefer flying a specific airline or staying at a particular hotel chain? If so, consider co-branded credit cards that are affiliated with those brands. These cards often offer benefits like free checked bags, priority boarding, and elite status perks. Alternatively, if you prefer more flexibility, a general travel rewards card that earns transferable points might be a better choice.

Understanding Annual Fees and Other Charges

Many of the most lucrative travel rewards cards come with annual fees. While it might seem counterintuitive to pay a fee for a credit card, the benefits and rewards can often outweigh the cost. However, it's essential to carefully evaluate whether the value you receive from the card exceeds the annual fee. Also, be mindful of other potential charges, such as foreign transaction fees, late payment fees, and cash advance fees. Avoid these fees by paying your balance in full each month and using your card responsibly.

Comparing Card Features: APR, Credit Limit, and Additional Perks

Beyond rewards, consider other important card features like the Annual Percentage Rate (APR), credit limit, and any additional perks. The APR is the interest rate you'll pay if you carry a balance on your card. Ideally, you should aim to pay your balance in full each month to avoid interest charges. The credit limit is the maximum amount you can charge on your card. Ensure the credit limit is sufficient to accommodate your spending needs without exceeding your credit utilization ratio (the amount of credit you're using compared to your total credit limit). Additional perks might include travel insurance, purchase protection, and access to airport lounges.

Maximizing Your Travel Hacking Credit Card Rewards Points: Earning Strategies

Once you've chosen the right credit cards, it's time to focus on maximizing your earning potential. Here are some proven strategies to accumulate travel hacking credit card rewards points quickly and efficiently.

Meeting Minimum Spending Requirements for Sign-Up Bonuses

As mentioned earlier, sign-up bonuses are a goldmine for accumulating points. To earn these bonuses, you need to meet a minimum spending requirement within a specified timeframe. Plan your spending strategically to ensure you meet the requirement without overspending. Consider using your new card for all your everyday purchases, and if necessary, pre-pay bills or make larger purchases that you were already planning to make.

Utilizing Bonus Categories for Accelerated Earning

Take advantage of bonus categories to earn extra points on specific types of purchases. Use the right card for the right purchase to maximize your rewards. Keep track of your spending and the bonus categories offered by each of your cards. Many cards offer bonus rewards for dining, travel, gas, groceries, and other common spending categories.

Referral Bonuses: Share the Love and Earn More

Many credit card companies offer referral bonuses when you refer friends or family members who are approved for a new card. This can be a lucrative way to earn extra points. If you're happy with your credit card, share it with others and reap the rewards. Be sure to check the terms and conditions of the referral program for any limitations or restrictions.

Leveraging Shopping Portals and Online Marketplaces

Shopping portals are online platforms that offer rewards points or cashback when you shop through them at participating retailers. Many credit card companies and airline loyalty programs have their own shopping portals. Before making an online purchase, check if the retailer is available through a shopping portal and click through the portal to earn extra rewards. Some credit card companies also offer online marketplaces where you can redeem your points for merchandise or gift cards. While the redemption rates in these marketplaces may not be as favorable as redeeming for travel, they can still be a useful option.

Redeeming Travel Hacking Credit Card Rewards Points: Smart Redemption Strategies

Earning points is only half the battle. The real magic happens when you redeem them strategically to maximize their value. Here are some tips for redeeming travel hacking credit card rewards points like a pro.

Understanding Redemption Options: Travel, Cash Back, and Merchandise

Most travel rewards credit cards offer a variety of redemption options, including travel, cash back, and merchandise. Generally, redeeming for travel offers the best value. Cash back redemptions typically offer a lower value per point, and merchandise redemptions often provide the least favorable value. Focus on redeeming your points for flights, hotels, or other travel-related expenses to maximize their worth.

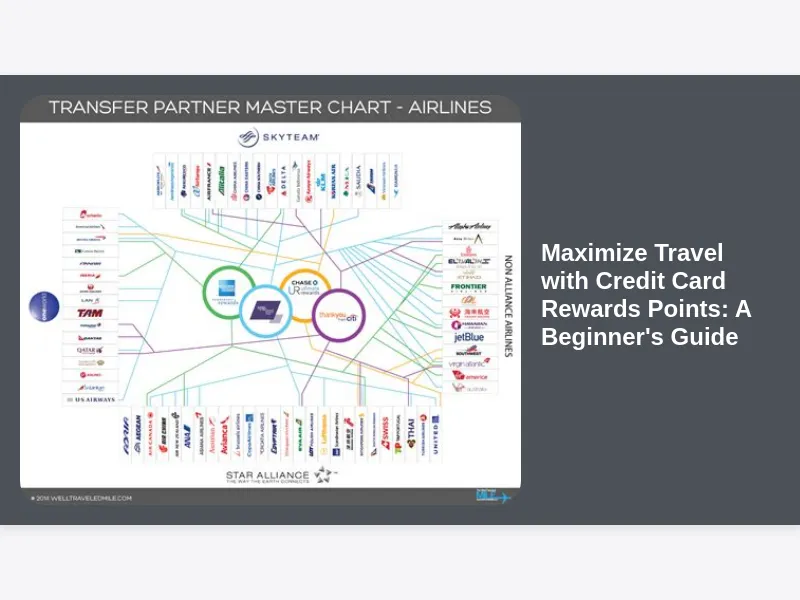

Maximizing Value Through Airline and Hotel Transfer Partners

One of the most powerful strategies for maximizing your points is to transfer them to airline and hotel partners. Many credit card rewards programs partner with airlines and hotels, allowing you to transfer your points to their loyalty programs at a specific ratio (e.g., 1:1). By transferring your points and booking directly through the airline or hotel, you can often find award flights or hotel rooms that offer significantly more value than booking through the credit card's travel portal.

Booking Award Flights and Hotel Nights Strategically

When booking award flights and hotel nights, flexibility is key. Be willing to adjust your travel dates or destinations to find the best deals. Award availability can vary significantly depending on the airline, hotel, and time of year. Consider traveling during the off-season or on less popular days of the week to increase your chances of finding available awards. Also, be aware of blackout dates, which are dates when award travel is restricted.

Using Points for Upgrades and Other Travel Perks

In addition to flights and hotels, you can also use your points for upgrades, such as upgrading from economy to business class or from a standard room to a suite. Upgrades can significantly enhance your travel experience, but they often require a substantial number of points. Consider whether the upgrade is worth the points based on your individual preferences and budget. You can also use points for other travel perks, such as lounge access, priority boarding, and travel insurance.

Common Mistakes to Avoid in Travel Hacking

Travel hacking can be incredibly rewarding, but it's also easy to make mistakes that can cost you points, money, or even damage your credit score. Here are some common pitfalls to avoid:

Missing Minimum Spending Requirements

Failing to meet the minimum spending requirement for a sign-up bonus is a major setback. Make sure you understand the requirements and have a plan to meet them before applying for a new card.

Carrying a Balance and Paying Interest

The interest charges you pay on a credit card can quickly negate the value of any rewards you earn. Always pay your balance in full each month to avoid interest charges.

Overspending and Going into Debt

Travel hacking should not encourage you to overspend or go into debt. Stick to your budget and only charge what you can afford to pay back. Don't let the allure of rewards lead you into financial trouble.

Neglecting Credit Score and Credit Utilization

Your credit score is an important factor in determining your eligibility for credit cards and loans. Monitor your credit score regularly and take steps to improve it if necessary. Keep your credit utilization ratio low by using only a small portion of your available credit.

Not Understanding the Terms and Conditions

Always read the terms and conditions of your credit card agreements and rewards programs. Understanding the rules and restrictions will help you avoid surprises and maximize your benefits.

Resources and Tools for Travel Hacking Success

Fortunately, the internet provides access to a wealth of information and tools to help you succeed in travel hacking. Here are some valuable resources to explore:

- The Points Guy: A popular website that provides news, reviews, and advice on credit cards, travel rewards programs, and loyalty programs. https://thepointsguy.com/

- Doctor of Credit: A website that tracks credit card offers and provides detailed analysis of their terms and conditions. https://www.doctorofcredit.com/

- AwardWallet: A tool that helps you track your loyalty program balances and expiration dates. https://awardwallet.com/

- Reddit's r/churning: An online community where travel hackers share tips, strategies, and experiences. (search on Reddit)

Conclusion: Start Your Travel Hacking Journey Today

Travel hacking with credit card rewards points is a powerful way to make your travel dreams a reality. By understanding the basics, choosing the right credit cards, maximizing your earning potential, and redeeming your points strategically, you can unlock incredible travel experiences at a fraction of the cost. So, take the first step today and start your journey towards a world of affordable and unforgettable adventures!